The Samurai Strategy

Thomas Hoover

Produced by Al Haines

==============================================================

This work is licensed under a

Creative Commons Attribution 3.0 Unported License,

https://creativecommons.org/

==============================================================

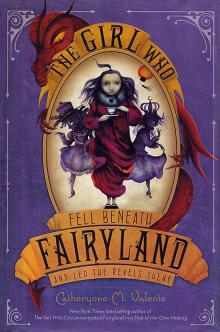

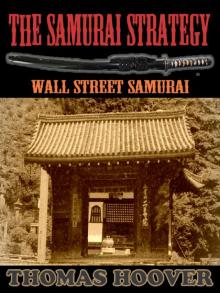

THE SAMURAI STRATEGY

_"A financial thriller right out of the headlines." _Adam Smith

A high-finance, high-tech thriller that correctly predicted the 1987stock market crash. It was the first fictional treatment of a majorinternational concern of the Eighties. Set in locales as diverse asWall Street and the offices of Japan's powerful Trade Ministry, THESAMURAI STRATEGY describes a scenario of murder, worldwide currencymanipulation, a revival of Japan's smoldering nationalism, and is setagainst a background of a new high-tech computer milieu. MatthewWalton, a freelance corporate 'takeover' lawyer is hired by amysterious Japanese industrialist to purchase a New York officebuilding and begin a massive 'hedging' in the financial markets. Twoweeks later, off an island in the Inland Sea, divers working for theindustrialist's organization, recover the original Imperial Sword,given to Japan's first Emperor by the Sun Goddess, Japan's 'Excalibur',and lost in a sea battle in 1185. He forms an '800-Year Fund' andbillions of yen flow to his fingertips. He then dumps all theTreasuries Japan had acquired and devastates the American economy.

As the story rushes to its stunning conclusion, Matt Walton goes toJapan and determines that the 'Imperial Sword' is, in fact an unusualantique he once owned himself.

BOOKS BY THOMAS HOOVER

Nonfiction

Zen Culture

The Zen Experience

Fiction

The Moghul

Caribbee

Wall Street Samurai (The _Samurai_ Strategy)

Project Daedalus

Project Cyclops

Life Blood

Syndrome

All free as e-books at

www.thomashoover.info

Wall Street Samurai

(The Samurai Strategy)

Thomas Hoover

www.thomashoover.info

THE SAMURAI STRATEGY A Bantam Falcon Book / June 1988

All rights reserved. Copyright (C) 1988 by Thomas Hoover.

Bantam Books are published by Bantam Books, a division of BantamDoubleday Dell Publishing Group, Inc.

OPM 0 9 8 7 6 5 4

Key Words:

Author: Thomas Hoover

Title: The Samurai Strategy

Wall Street, Japanese Stock Market, Treasury bonds, Stock Market,Imperial Sword, Emperor of Japan, Japanese History, Supercomputer

_The following story is entirely imaginary . . . I hope._

CHAPTER ONE

New York, New York. Friday, early September, dusk. Heading uptown onMadison. Sheets of icy rain washed the pavement, heralding theonslaught of autumn and the miserable winter to come. The city waspoised for its cruelest months, that twilight of the spirit whenstrangers arm-wrestle for taxis, nobody has time to hold a door, andyou cherish every fleeting human kindness.

Bring on the blizzards, the holiday madness. This winter I was planningsomething long overdue. To treat my daughter Amy, the Madame Curie ofher ninth grade, to a real vacation. Just us. We'd leave atThanksgiving and stay gone through the Christmas break. She got to livewith me three months a year, and December was by God going to be one ofthe months. School? She'd already skipped a year; maybe she was alittle too fast-track for thirteen.

Since Joanna, my ex, had already lined up her own holiday excursion(Amy the spy claimed it was with some divorced Tishman VP), she hadn'tbothered inventing the usual roadblocks. Clear sailing. We'd open thehouse down in St. Croix and spend a month getting reacquainted. Work onthe tan and some postgraduate snorkeling, a strategic move while Istill enjoyed a small sliver of her attention, before a certain"totally terrific" skateboard virtuoso finally got around to noticingher. Only a couple of jobs needed finishing, but they'd be wrapped upwith weeks to spare.

That night, in truth, had its moments of nostalgia. The destination wasSotheby's auction house, a place where Matthew Walton was greeted byname at the cashier's window. Home away from home for obsessivecollectors. I leaned back

against the vinyl seat of the Checker, letting the rhythm of thestreetlight halos glimmer past, and reflected on all those happy nightsI'd made the trek with Joanna. She'd had no real interest in mycollecting hobby, Japanese samurai swords and armor, but she was alwaysa decent sport about it. Besides, she had her own passions. While I wasagonizing over long blades and short blades, she'd sneak off and browsefor something French and nineteenth century and expensive. Fact is, I'dusually plan ahead and have something of my own on the block just topay for that little sketch, or print, she suddenly had to have. Out ofhabit I'd even shipped up a couple of mistakes for the auction thisevening (a hand axe and a lacquered-metal face guard).

Though tonight's sale had only a few odd items in my specialty, theslim offerings actually suited the occasion. It left the evening open,time for the real agenda--getting things rolling with a new client who'dinexplicably handed me a job as simple as it was strange.

The man, name of Matsuo Noda, had rung all the way from Japan Fridaybefore last, introduced himself in generalities, then declared he had apressing legal matter requiring both speed and confidentiality.Inquiries had led him to me. Would I have time to help him locate anoffice building to buy? He claimed he was head of a Kyoto consultingoutfit that called itself Nippon, Inc., and he was looking forsomething in midtown, seventy-million range.

Honestly I couldn't quite believe he was serious at first. Why this job(just a little legwork, really) for somebody he'd never even met? Icould swing it, sure, but now that Japanese investors were snapping upU.S. property right and left, who needed some ex-Texan turned New Yorklawyer knocking around? There was no rational reason to engage acorporate attorney.

"Out of curiosity, why aren't you working through one of the Tokyofirms here in New York, say, Hiro Real Estate or KG Land? Surely theycould--"

"Mr. Walton," he interrupted smoothly but firmly, "allow me to say Ihave my reasons. May I remind you I stressed confidentiality."

"Merely asking." I took a deep breath. The connection was distorted, ahigh-pitched hum in the background, as though he wasn't usingcommercial phone lines. "If you want, I can look around and see what'son the market . . . and in the meantime how about sending along aprospectus, just for the file?"

"Assuredly," he said, "and I do look forward to working with you."After a few more polite nothings, he abruptly closed out the call.

Peculiar. That wasn't how the Japanese road show usually did business.From what I'd seen, Tokyo invests very cautiously and deliberately,sometimes "researching" a deal half to death. I momentarily wondered ifit wasn't just one of the jokers from my old partnership pulling myleg.

He was real enough. A brochure arrived by overnight air, bound inleather, with a flowery covering letter. Two problems: most of thething was in his native tongue, and what I could read didn't tip hishand. From the looks of its public disclosures, Nippon, Inc. was merelysome kind of money manager for Japanese investment banks; it had almostno assets of its own. All I could find listed were a few milliondollars, lunch money for a Japanese outfit, mostly cash parked in someshort-term Euroyen paper. That, and a head office in Kyoto, was the sumof it. What's more, Noda only worked with Japanese banks and firms. Noforeign clients.

So why did this man suddenly require space in New York? An entirebuilding. I honestly couldn't figure it. On the other hand, with anyluck the whole deal probably could be put together

with a few phonecalls.

By way of introduction, let me say that I worked, technically, as astraightforward attorney-at-law. I say "technically" because I was, infact, a freelance defensive back in the corporate takeover game, whichthese days is anything but straight. You'd have to go back to theroaring twenties to find so many creative screw-jobs.

Some people are drawn to power; guess I'm more attracted to the idea ofoccasionally whittling it down to size. So when some hotshot raiderfound a happy little company whose breakup value was worth more thanthe current stock price, then decided to move in and grab it, loot theassets, and sell off the pieces--one of the players apt to end updownfield was Matt Walton. For reasons that go a long way back, I likedto break up the running patterns of the fast-buck artists. It's a gamewhere you win some and lose some. The trick is to try and beat theodds, and I suppose I'd had my share of luck.

Give you a quick example. Back in the spring, a midsize cosmeticsoutfit called me in as part of their reinforcements to fight anavaricious rape, better known as a hostile takeover, by one of theirbiggest competitors. After looking over the balance sheet and sharesoutstanding, I suggested they divest a couple of unpromising consumerdivisions--namely a "male fragrance" line that made you smell like a kidleaving the barbershop, and a "feminine hygiene" product that couldhave been a patent infringement on Lysol--and use the proceeds to buyback their own common shares. We also threw together a "poison pill"that would have practically had them owning anybody who acquired morethan twenty percent of their stock. Our move scared hell out of thecircling vultures and reinforced my reputation on the Street (undulyharsh, I thought) as a give-no-quarter son of a bitch.

Another fact worth mentioning is that I worked without benefit of areal office; after selling off my piece of the law partnership, Ioperated out of my place downtown, with a telephone and a couple ofcomputers. A kindly gray-haired dynamo by the name of Emma Epstein, whohad a rent- controlled apartment down the block, dropped by afternoonsand handled correspondence, filing, matrimonial advice, and theoccasional pot of medicinal chicken soup. The only other member of mystaff was a shaggy sheepdog named Benjamin, who served as securitychief, periodically sweeping the back garden for the neighbor's cat.That was it.

Oh, yes, one other item. Crucial, as it turned out. I'd always been acollector of something--once it was antique spurs, for chrissake--butabout ten years earlier I'd started to get interested in thingsJapanese and ended up going a little overboard about old swords andsuch. Joanna's unscheduled departure managed to burn out a lot of mycircuits, and what had been merely an obsession grew into something alittle crazy. For a year or so I became, in my own mind at least, asort of American _ronin_, a wandering samurai.

You see, the Japanese warriors had a code that said you ought to liveevery moment in full awareness of your own mortality. When you adoptthis existential outlook, so they claimed, all regrets, emotions,complaints, can be seen as an indulgence. You're ready to meet lifehead-on, to risk everything at a moment's notice. That's the only wayyou ever discover who you really are, and it's supposed to make youmarvelously detached.

Almost enough to make you forget how your raven-haired, brilliant, sexymate packed it in one New Year's Eve twenty

months past . . . when you called late from the office, again . . .after declaring that that was the goddam last straw and apparently theonly thing you could find worthy of undivided attention came printed ongoddam computer paper and she was goddam sick of it--which shedemonstrated the next day by slamming the door on her way out.

Add to which, she used my momentary disorientation to get custody ofAmy. So while I was battling corporate Goliaths, I let her walk offwith the only thing I would have given my life for. The more time wentby, the more I wanted to kick myself. Alex Katz (of Walton, Halliday,and Katz--now minus the Walton) read the custody agreement the day afterI signed it, sighed, glared over his smudgy half-lenses, and announcedthat this kind of unconditional surrender should only be signed on thedecks of battleships. What did he have, a law partner or a fuckingschlemiel?

He was right, for all the wrong reasons. Not long after, I cashed in mypiece of the firm and went independent. Win or lose, it's best to sortthings out on your own. I was then forty- three, six one, and weighedin at an even one eighty. There were a few lines on the face andseveral more on the psyche, but the sandy hair was mostly intact, and Icould still swim a couple of miles if absolutely essential. Maybe therewas still time for a new start. Part of that therapy was going to beour trip.

Perhaps I should also add that I'd had a brief "rebound" fling, forwhat it was worth. The lady was Donna Austen, a name you'll recognizeas belonging to that irrepressibly cheerful "Personalities!" host onwhat Channel Eight likes to term its Evening News. She'd called about asegment on the subject of the cosmetics company takeover, then verymuch in the local press, and I'd said fine. She ended up downtown, andsoon thereafter we became an item. She was the closest I'd had to agirlfriend, and at that it was mostly an on-again, off-again thing--which terminated in an event reminiscent of the Hindenburg's lastflight. In the aftermath I went back to chatting with Amy every day onthe phone, putting together stock buyback packages, and collectingJapanese swords.

Anyway, while the cab waited for a light, worn-out wipers squeaking, Ifumbled around in my coat pocket and extracted the _meishi_, thebusiness card, one side in English, the other Japanese, that had beenincluded with Noda's letter. He'd

personalized it with a handwritten note on the side with English print.Now, I'd kept track of the new Japanese investment heavies in town--Nomura, Daiwa, Nikko, Sumitomo--since you never know when a corporationmight need some fast liquidity. They were starting to play hardball,and these days (with all that cheap money back home) they wouldunderbid a nine-figure financing deal before Drexel Burnham could spell"junk bond." But Nippon, Inc.? Never heard of the outfit.

Well, I thought, you'll know the story soon enough. The driver had justhung a right on Fifty-seventh and was headed east toward York Avenue.I'd called that afternoon to lower the reserve on one of my lots andhad been told that because of some union squabble the preview wouldcontinue till just before the sale, now scheduled to kick off at eight-thirty. It wasn't quite seven yet, so we would have at least an hour torun through my list of prospective buildings.

As the cab pulled up next to the chaste glass awning, I took a deepbreath, shoved a ten through the Plexiglas panel between the seats, andstepped out. While the battered Checker (lamented remnant of avanishing species) squealed into the dark, I unbuttoned my overcoat andheaded up the steps. A few grim-faced patrons milled here and there inthe lobby, but nobody looked familiar. There was even a new girl at thedesk by the stairs, ash blond and tasteful smoked pearls, pure BrynMawr art history. A class act, Sotheby's.

It appeared that most of the Japanese crowd was already upstairs,undoubtedly meditating on their bids with the meticulous precision ofthe Orient. I was headed up the wide, granite steps myself when Idecided to check out the downstairs one last time.

Hold on, could be there's a possibility. Waiting over by the coatcheck, thumbing the catalog, was a distinguished-looking guy,retirement age, wearing a light, charcoal suit. Italian. Unlike theusual Japanese businessmen, he clearly didn't assume he had to dresslike an undertaker and keep a low profile. No, probably just someMitsubishi board member thinking to diversify his portfolio with a few_objets d'art_.

Abruptly he glanced up, smiled, and headed my way. I realized I'd beenrecognized.

"Mr. Walton, how good of you to come." After a quick bow he producedhis card, a formality that totally ignored the fact he'd already sentme one. As convention required, I held it in my left hand and studiedit anew while I accepted his hearty American handshake. "It's apleasure to meet you. At last."

At last?

I let that puzzler pass and handed over a card of my own, which he heldpolitely throughout our opening ritual, then pocketed.

Noda had a mane of silver hair sculptured around a lean, tan fac

e, andhe looked to be somewhere between sixty and seventy. Though his darkeyes were caught in a web of wrinkles that bespoke his years, they hada sparkle of raw energy. He moved with an easy poise, and the initialimpression was that of a man eminently self-possessed. He had thatsturdy, no-nonsense assurance usually reserved for airline pilots. Ifyou had to entrust somebody with your wife, or your life savings, thisman would be your pick.

Well, my new client's a mover, I told myself. All the same, I acceptedhis hand with a vague twinge of misgiving. What was it? Maybe somethingabout him was a little too precise, too calculated.

"Mr. Walton, permit me to introduce my personal consultant." Helaughed, a slight edge beneath the charm, and more wrinkles shotoutward from the corners of his eyes. "I always seek her approval ofmajor acquisitions, particularly those of the Heian period, herspecialty." He turned with what seemed obvious pride and gesturedtoward the tall Japanese woman standing behind him. I'd been so busysizing him up I'd completely failed to notice her. "I must confess sheis, in fact, my . . . niece. I suppose that ages me." Another smile."You may possibly be familiar with her professional name, so perhaps Ishould use that. May I introduce Akira Mori."

Who? I stared a second before the face clicked into place. And thename. They both belonged to a well-known commentator on Tokyotelevision. Only one slight problem: her "specialty" had nothing to dowith art.

"_Hajimemashite_. How do you do, Mr. Walton." She bowed formally and, Inoticed, with all the warmth of an iceberg. No surprise--I knew heropinion of Americans. She did not bother meeting my eye.

She looked just as I remembered her from the tube. A knockout. Her hairwas pulled back into a chignon, framing that classic oval face, and herage was anybody's guess, given the ivory skin and granite chin. She waswearing a bulky something in black and deep ocher by one of the newTokyo designers. For some reason I was drawn to her fingernails, longand bronze. The parts, a mixture of classic and avant-garde, did notseem of a piece, the kind of detail you didn't notice on the TV. Butthere was something more important than her looks.

I'd been to Tokyo from time to time for various reasons, and I'd hearda lot of stories about this lady. Fact is, you didn't have to beJapanese to know that Akira Mori was easily Japan's most listened-tomoney analyst. You've probably seen her yourself in snippets of thatweekly chat show she had on NHK, which used to get picked up by thenetworks here when they needed a quick thirty seconds on "Japan ThisWeek" or such. Her ratings had little to do with the fact she's alooker. She was, talk had it, an unofficial source for officialgovernment monetary policy. Akira Mori always had a lead on exactlywhat was afoot, from the Bank of Japan to the Ministry of Finance, evenbefore the prime minister broke the news.

Miss "Mori," whoever the hell she was, had some very well placedfriends. Tell you something else, she didn't go out of her way to findflattering things to say about how Uncle Sam handled his bankbook thesedays. Her appearance here made Noda's unorthodox office plans even moreperplexing.

"We both appreciate your taking time from your schedule to meet withus." He bowed again. "We've been looking forward to having you join usat the sale."

While Akira Mori appeared to busy herself with a catalog, Noda and Igot things going with that standard formality preceding any seriousJapanese professional contact: meaningless chat. It's how they set uptheir _ningen kankei_, their relationship with the other guy, and it'salso the way they fine-tune their _honne_, their gut feeling about asituation. Any greenhorn foreigner who skimps on these vital nicetiesruns the risk of torpedoing his whole deal.

In response to my pro forma inquiries, Matsuo Noda declared he likedNew York, had even lived here for a while once, honestly found it lesshectic than Tokyo, usually stayed these days at the Japanese hotel downon Park but sometimes picked the Plaza when he needed to be closer tomidtown. He adored La Grenouille and thought La Tulipe overpraised.When I pressed him, he declared his favorite Japanese place to dine wasNippon, over in the East Fifties (maybe he merely liked the name, butit was my pick as well).

After he had in turn solicited my own views on Sotheby's, a couple ofthe galleries down Madison, and various North Italian eateries, hesuggested we go on upstairs and preview the lots.

All the while Miss Mori appeared to ignore us, standing there like astatue of some Shinto goddess, except for the occasional tug at herdark hair. Maybe she didn't give a damn about this obligatory smalltalk, thought it was old-fashioned. Or possibly she liked the idea ofbeing the only one not to show a hand. And as Noda led the way uptoward the exhibition rooms, she trailed behind like a dutiful Japanesewoman--while we, naturally, continued to talk of everything except, Godforbid, why we were there.

In the first room we were suddenly in my arena--samurai swords andbattle gear.

"This is your special interest, is it not, Mr. Walton?" Noda smiled,then turned to admire the row of shining steel _tachi_, three-foot-longrazors, now being watched over by a trio of nervous guards. Sotheby'sdidn't need some amateur Toshiro Mifune accidentally carving up theclientele. "I understand you have a notable collection yourself."

What? What else did he know about me?

Easy, Walton. Play the game. I knew what a Japanese would expect inreply.

"Matter of fact, I've lucked onto a couple of items over the years."Then the standard disclaimers. My own painstaking collection was merelya grab bag of knickknacks, the fumbling mistakes of a dabbler, etc.,etc.

Noda monitored this culturally correct blarney with satisfaction. "Asit happens, Mr. Walton, I was in Nagoya last year when several of yourpieces were on loan for the show at the Tokugawa Museum. I still recallcertain ones, particularly that fine fifteenth-century katana,attributed to the Mizuno clan. Unusual steel. No date or mark of theswordsmith, but a remarkable piece all the same." A split-second pause."Your reluctance to part with it was most understandable."

This man had done his homework! Or maybe he'd been the one who hadtried to buy it. The steel was unusual, too heavy on copper. I'd evenhad a little metallurgical testing done on it down at Princeton, justto prove that hunch. But it was no big

deal, merely an oddity that had fallen my way via an estate sale. Therewas an anonymous inquiry shortly after the exhibition opened, with aninsistent offer, but I'd turned it down.

Poker time. "I was honored. Your figure was more than generous."

He laughed--bull's-eye. I watched as he glanced back at Miss Mori, maybea bit nervously. Then he returned his attention. "Merely a smallgesture for the museum. I felt it should be back in Japanese hands." Hecontinued, his voice now sober. "You do understand?"

"Certainly." I just stared.

"Good. I see I was right." He had paused to examine a large monochromescreen. It was eighteenth century and he inspected it with only mildinterest, then moved on.

I was still knocked over. Could that be why he'd retained me as hisU.S. legal counsel? Because of some damned antique sword? Okay, I wasalready getting the idea Matsuo Noda might be a trifle eccentric, butall the same . . .

"Interesting." He was pointing at a long picture, part of a serieslocked in a wide glass case. "_Honto ni omoshiroi, desu ne_?'

Miss Mori was already there. In a voice scarcely above a whisper sheproceeded to give him a rundown of pros and cons. It was the first timeI'd noticed any enthusiasm out of the woman all night.

I checked my catalogue. The piece was a Heian hand scroll, said to be"exceedingly rare." After a few moments Noda motioned me over. "Perhapsyou could give us your opinion. What do you think?" He pointed down."The subject is intriguing. These are ladies-in-waiting for theemperor, Fujiwara. Notice the delicate refinement of the coloring, thematched fabrics, each enhancing the other like flowers in a bouquet.That was eight centuries ago, just before the rise of the first shogun,the first 'generalissimo' who would rule in the emperor's name."

When he said "shogun," niece Mori shot him a quick admonitory glance.There was some kind of unmistakable electricity passing. Something leftunspoken.

"The Heia

n era ended with the great conflict between the Heike andGenji clans that led to the death of the ruling emperor in 1185 and theloss of the imperial sword at sea." Next he said something in gutturalJapanese to Mori, obviously very intent, and indicated one corner ofthe painting, where the emperor sat. Her reply was quick and curt. Now,I only know a little of the language, maybe a couple of cuts aboveBerlitz level, but I did manage to pick up she wasn't talking about thepainting. Something to do with the emperor himself, though I missed therapid-fire delivery.

In response to Noda's question I tried to sound intelligent, saying theink coloring looked well preserved, or some such auction house mumbojumbo. It wasn't my thing really, which the man surely knew. He seemedto know everything else about me. After he listened politely, theyswitched back to Japanese and finally settled on a bid. I watched asshe marked it in the catalogue--low six figures.

Walton, I thought, you're dealing with a pair of heavyweights.

By then I'd decided not to bother bidding on anything. There were toomany curious twists, not to mention the building deal. Surely theritual had gone far enough, the samurai negotiating ploy of making youradversary be first to reveal his game plan.

Why not bring up why we were there, just for the hell of it?

When I did, Noda betrayed a fleeting smile. "But of course, thebuilding." He made it sound like some kind of trivial annoyance, anuisance to get out of the way so we could all get back to the seriouswork of admiring the pretty pictures.

_Touche_, I thought. Round one to Noda, on points. "I assume you've hada look at the package of materials I messengered up to your hotelyesterday?"

A broker friend had put together some listings for office buildingsaround midtown--it turned out the market was softening a touch due tothe latest construction binge--and I'd hoped that maybe something wouldcatch Noda's eye. Matter of fact, there were a couple of real bargainsover near Sixth.

"My people have examined it in detail. We would like to move forward onthe twenty-story building on Third Avenue."

For a second I thought he was joking. Sure we'd tossed in the write-up,because it fit his profile, but it was a crazy all- cash deal, and theywanted ninety million, firm.

"Did you read the terms on that one? It's all--"

"There is a vacant floor, is there not? Available immediately?"

"Well, yes, but--"

"There may be a few items to clarify--we would like your legal opinionconcerning the leases of the existing tenants--but nothing major. If theseller is prepared, I think we could even go to contract early nextweek, while I'm here. I would like very much to close as soon aspossible. If some of my staff can meet with the seller's attorneys overthe weekend, perhaps we can start work."

Over the weekend? No counter bid, no haggling? Now, you didn't have tobe a brain surgeon to realize this was a fast-track deal; Matsuo Nodawas a man in a hurry. "Looks like you just may have yourself a piece ofproperty. I'll try and get hold of them in the morning, if I can, andstart the ball rolling."

"Excellent." He hesitated a moment, as though framing his words, thencontinued, "But in fact, Mr. Walton, we'd actually wanted to meet youtonight for an entirely different purpose. I'd hoped we might beworking together on, well, some additional matters."

"Something else?"

"As you might surmise, we are not enlarging our presence here to nopurpose. Tonight I wanted to tell you something about the objectives ofNippon, Inc. And then let you decide if what we propose merits yourparticipation. Your financial expertise could make you a great asset tous."

Hang on, I thought. This thing is starting to go a little fast.

"What do you have in mind?"

"First let me say you are a man I have long admired. Your style is notunlike my own. We both understand the importance of moving cautiously,of keeping our adversaries off guard. Most of all, there is a rigorousdiscipline about your work. That is the style of _bushido_, the way ofthe warrior." He smiled, and his tone lightened. "I think we couldcooperate very effectively."

Already I was wondering whether I really wanted to "cooperate" anyfurther with Matsuo Noda. Something about the man, and Miss Mori, mademe very nervous. Besides, I was trying to finish off work now, notbegin more. But he'd found out the one line that would keep melistening. He'd somehow discovered I was a deep admirer of the old-timemilitary strategists of the East--such as Sun Tzu and Miyamoto Musashi.

Like a hostile takeover bid, the ancient Japanese way of

combat was ritualized, as mounted warriors rode out, announced theirlineage (to the SEC?), then matched up with men of equal renown. Thesamurai prized flexibility over brute strength; they had steel swordsthat handled like scalpels and body armor that was a woven mesh oflacquered-iron scales laced together in rows to create a "fabric" ofmetal. Those weapons and armor made for agile movement, easy feints,fast changes in strategy--all trademarks of mine on the corporatetakeover battlefield.

As a result, I fancied myself some kind of samurai too. . . .

The question was, how did _Noda _know this?

For some reason just then I glanced over toward Akira Mori. Sheappeared to be studying a scroll with the detachment of a Zen monk in_zazen_ meditation, but she wasn't missing a syllable.

"Care to run through whatever it is you have in mind?" I indicated oneof the ottomans along the side of the room, now clearing as biddersrose to go inside. I watched as the dark- suited Japanese businessmenfiled past, none with Noda's sense of style, and noticed that severalseemed acquainted with him, pausing to offer obsequious bows.

"With pleasure." He settled himself. Mori, now looking over somescreens, still didn't elect to join us. "First, may I presume youalready know something of Nippon, Inc.?"

"No more than what I gleaned from that package you forwarded. Almostnothing, really."

He laughed, a flash of even teeth. "Perhaps I should be pleased. Thesedays too much visibility in the U.S. can sometimes stir up 'friction'."

"Your prospectus indicated you help banks manage capital, so I assumeyou're looking to enter the financial picture here."

That was the funny part, recall? There was no indication of any U.S.action in his prospectus. Yet I knew that, overall, Japan's U.S.investment, private and public, was in the tens and hundreds ofbillions. Pension funds and industries were building factories,financing corporations, snapping up Treasury paper. Japan had become amajor source of fresh money for the U.S. and for the world. But Nippon,Inc. wasn't one of the players.

"Yes, we intend to be concerned, initially, with the position ofJapanese capital in the U.S. We are particularly interested in thematter of Treasury debentures."

That was what anybody would have figured. Just that week the Journalhad noted that Japanese investors were expected to cover half of ourTreasury overdrafts for the year. They were advancing us the bucks tokeep up that spending spree known as the national deficit. They sold usToyotas; we sold them federal IOUs, using the proceeds to buy moreToyotas. In effect they were financing the good life, supplying us the"revolving credit" to buy their cars and DVDs and semiconductors.

"Treasuries always make a lot of sense." I picked up the thread. "Fullfaith and credit of the U.S. government, all the rest."

"Quite so, Mr. Walton, but since all things are theoretically possible,over the past few months I've undertaken a small program throughsubsidiaries of Nippon, Inc. to begin cushioning Japan's exposure inyour Treasury market somewhat." He paused. "Now that my effort may beexpanding significantly, I was wondering if perhaps you might consentto serve as our American agent in that endeavor."

For a second I didn't grasp what he was driving at, probably because myinvolvement seemed totally unnecessary. Surely he realized Treasurieswere bought and sold here every day on the open market through dealerbanks? No big deal. Why bother hiring a middleman?

"I can make this quick. Why don't you just contact some of theauthorized Japanese brokers here in New York? You must have used thembefore. Nomura Securities is well respected. There's

also NikkoSecurities. And Daiwa Securities America. They're all primary dealersin Treasury paper now. Buy or sell whatever you like."

Noda nodded. "Of course. But we both know the financial markets can bevery delicate. Impressions count for much, which is why I have chosento keep a low profile. Consequently, I would prefer to continue tooperate for a time outside normal channels. And in that regard, I nowbelieve it would be desirable to have an experienced American financialspecialist assist us. You, in particular, would be ideal."

I studied him. "Let me make sure I understand this. You're asking me tostep in and begin fronting for you here in the Treasury market?"

"That is correct, Mr. Walton." He rose and strolled over to the row of_tachi _swords, where Miss Mori was still standing. They were lying ona spread of dark velvet, and she was scrutinizing them with aconnoisseur's eye.

Now, I'd like to think I was a quick study of a situation, but this onewas definitely out of whack somehow. If all Noda wanted was to rollover a little government paper, why the hush-hush? More to the point,why a whole building in midtown? He could easily do it from Tokyo. Thescenario didn't compute.

"Before this conversation goes any further, I'd like a better idea ofthe kind of activity you're talking about. Selling Treasuries? Movingthe funds into corporate bonds or munis? Commercial paper, equities."

"Sell?" He abruptly paused to watch as the staff began carefullyassembling the weapons to take inside for the sale, and his mind seemedto wander. "You know, Mr. Walton, the sword always has held thegreatest fascination for me. To make one of these, layers of steel ofdifferent hardnesses were hammered together like a sandwich, thenreheated, hammered out, folded, again and again, until there wereperhaps a million paper-thin layers." He pointed to one of the longblades now glistening in the light. "You cannot see it, of course, butthey used a laminate of soft steel for the core, harder grades for thecutting edge. And whereas the edge was tempered quickly to preserve itssharpness, the core was made to cool very slowly, leaving it pliant."He suddenly smiled with what seemed embarrassment and turned back. "Itake great inspiration from the sword, Mr. Walton. The man holding onemust learn to meld with the spirit in the steel. He must become likeit. What better than to meet the world with your hardest surface, yetmaintain an inner flexibility, able to bend to circumstance as the needmay arise?"

He stood a moment as though lost in some reverie then chuckled."Sometimes I do tend to go on and on. I believe it was selling youasked about. The fact is you would not be actually selling Treasuryobligations."

"Then what . . . ?"

"Are you familiar with interest-rate futures?"

"Of course." The question was so unexpected I answered almost before Ithought. Futures contracts were part of the big new game on WallStreet, although most of the action was still out in Chicago, placeslike the Merc and the Board of Trade, left over from the old days whenfarmers sold their crops in advance at an agreed-upon price. The farmer"sold" his grain harvest to a speculator while it was still nothing butgreen sprouts. He was worried the price might drop before he got it tomarket; the speculator was praying it would head up. The farmer,interestingly, was selling something he didn't yet have. But even ifthe price of wheat suddenly tanked, he was covered.

These days futures contracts were traded for all kinds of things whosevalue might change with time. High on that list were financialinstruments such as Treasury notes and bonds, whose resale worth coulddrop if interest rates unexpectedly rose. If you owned a bond and wereworried it might go down in value, you could hedge your exposure with afutures contract, in effect "selling" it in advance at the currentprice and letting somebody else assume the risk of future marketuncertainty.

Modern finance being the marvel it is, you could even sell bonds youdidn't own, just like the farmer's nonexistent grain. The Wall Streetcrowd called this a "naked" contract, since you were obligated to goout and acquire that bond in the open market on the day you'd agreed todeliver it, even if the price had skyrocketed in the meantime. Or youhad to try and buy back the contract. Of course, you were betting thatprice would go down, letting you pocket the difference.

Pious spirits on the futures exchanges called these deals high financeand risk hedging. They operated, however, remarkably like legalizedgambling. Dabbling in interest-rate futures was not for those with adicey heart.

"Our objective," Noda went on, "is to cushion Japan's exposuresomewhat."

"With futures contracts?"

"Precisely. U.S. Treasury obligations are held by a variety ofinvestors in Japan, but up until now we have made very little use ofthe protection possible in your futures markets. Nippon, Inc. willconcern itself with that."

I listened thoughtfully. "So you're saying you want to create aninsurance program for Japanese investors in case the price ofTreasuries weakens?"

It made sense. If interest rates went up here, reducing the value oftheir government paper, then the price of his futures contracts wouldrise to offset the loss.

I glanced over at Japan's monetary guru, Akira Mori, who

was carefully examining her bronze fingernails. Was she the one behindall this sudden nervousness about America's financial health? Whatcould these two know that we didn't, I wondered. It was all a bitmysterious.

One thing was no mystery, though. Whatever was going on with MatsuoNoda and Akira Mori gave me a very unsettled feeling.

"I'm flattered." I looked him over. "But afraid I'll have to pass. Thisfall I plan to take off for a while and . . . catch up on some personalmatters that--"

"Mr. Walton," he cut in. "I would urge you not to lightly dismiss myproposal." He was staring back at me intensely. "I can only say for nowthat issues are involved . . . well, they encompass matters of graveinternational consequence." Another pause, followed by a noticeablehardening of tone. "Your other obligations cannot possibly be asimportant. It would be in your best interest to hear me out."

Want the truth? At that moment all my negative vibes about Matsuo Nodacrystallized. He wasn't threatening me exactly. Or maybe he was. Thelarge viewing room was all but empty now. Maybe he'd deliberatelywaited before getting down to his real agenda.

"My other 'obligations' happen to be very important to me just now."

"Then please consider rearranging them."

"Besides, my fees can be substantial." They weren't all thatsubstantial, but I was looking to slow him down.

"Your fees do not present a problem." He continued, "This afternoon aretainer of one hundred thousand dollars was deposited in your personalaccount at Chase."

"What in hell . . .!"

"Money is of no consequence in this matter, Mr. Walton. Time is."

"You seem awfully sure I'll agree."

"We expect your involvement to begin immediately. I cannot stress toostrongly the urgency of what you will undertake." He smiled thinly. "Ialso feel confident a man who enjoys a challenge as much as you do willfind our undertaking . . . intellectually rewarding."

Seems I was hired and I hadn't even said yes.

This guy had another think coming. Besides, he could get anybody to dowhat he wanted. He didn't need me. As I stood

there, I started trying to guess the dimensions of Matsuo Noda'sfinancial hedge. Taken all together, Japan probably had roughly ahundred billion and change tied up in U.S. government paper. No waycould he be thinking of covering more than a fraction of that. I knewplenty of law clerks who could do it, for godsake. A few phone calls toa couple of floor traders in Chicago . . .

"Look, the most I can do for you is recommend some very competentbrokers I know to help you out. There shouldn't be too much to it.You'll just have to go easy. You can't hit the market makers in Chicagowith too much action all at once. Prices get out of kilter. Then, too,there are exchange limits. . . ."

"That is why we will be trading worldwide." Noda withdrew a foldedsheet of paper from his breast pocket. "Perhaps you'd like to glanceover our program. These are cumulative totals, which include ouractivity to date, but we will

begin moving much more rapidly as soon asI've completed all the financial arrangements with our institutionalmanagers at home. Perhaps you will see why we need a monetaryprofessional."

I was still chewing on the "financial arrangements" part as I took thepaper, opened it, and scanned the schedule of contracts. While I stoodthere, the room around us sort of blurred out. I had to sit down again.All his talk about samurai and nerves of steel was for real.

Matsuo Noda had a program underway to sell futures on a pile of U.S.Treasury bills, notes, and bonds he didn't own, "naked," in an amount Ihad trouble grasping. I knew one thing, though: if interest ratesheaded down, raising the value of those presold obligations, he'd beforced to cover awesome losses. He'd be in a financial pickle thatwould make Brazil look flush. On the other hand, if some disasteroccurred and U.S. interest rates suddenly shot sky high . . .

Numbers? The CBOT's long-interest contracts, notes and bonds, are indenominations of a hundred thousand each; the Merc's short paper, billsand CDs, are in units of a million per. Finally I did some quickarithmetic and toted up the zeros. Something had to be wrong here.Nobody had balls that big. I decided to run through the figures again,just to be sure.

It was along about then that I realized all Noda's pious talk aboutsheltering Japanese widows and orphans had been purest bullshit.Resting there in my hand was the biggest wager slip in world history.Assuming enough players could be found worldwide to take his action, hewas planning to advance-sell U.S. Treasury IOUs in the amount of fivehundred billion dollars. A full quarter of our national debt.

His bet: something or somebody was about to push America over thebrink.